Wednesday, May 29

5 Things to consider when choosing a Funeral Home

by Ryan Starr

People typically select a funeral home because it has been recommended to them, they’ve been there before and the location is convenient for friends and family.

Most of the 100 or so funeral homes in the GTA accommodate all faiths and cultures, although many groups have favoured spots that cater to their community. For example, Benjamin’s Park Memorial Chapel and Steeles Memorial Chapel perform a large portion of the services for Jews and in most cases the remains are buried in Jewish cemeteries.

Service providers catering to the Muslim community in the GTA include the Islamic Foundation of Toronto, Scarborough Muslim Association andAftercare Cremation and Burial Service. These companies will look after the transporting of the body to a Mosque, where it is bathed and enshrouded, and then transfer it to the cemetery to be buried.

Muslims have traditionally been buried in non-denominational cemeteries across the GTA, but there are plans for a Shia-Sunni Muslim cemetery in Richmond Hill.

No matter the faith, the basic costs of a full service funeral remain the same. The average for a service, visitation, body preparation and interment or cremation is $4,663, according to the Ontario Board of Funeral Services, which regulates the industry. Benjamin’s says their average is about $4,800, while Aftercare says it is about $4,000 in their case.

If you go no frills, the costs can come down 50 per cent or more.

Here are the five things to keep in mind when looking for a funeral home:

1. Ask friends and family for a recommendation. How were they treated? What services were provided and at what price?

2. Ensure the funeral home is able to accommodate your religious and cultural needs.

3. Call around or go online and compare prices and features. Get a final quote in writing.

4. When getting a quote the main components include the cost of the body preparation, service, burial/cremation and the casket/burial container.

5. Every funeral director and transfer service operator is required by law to have price lists available at no charge and without obligation.

All funeral homes are overseen by the Board of Funeral Services a self-regulating body, set up under the Funeral Directors and Establishments Act. The board serves as a consumer protection agency and is the place to go when you have a complaint.

The board offers compensation when:

1.A pre-paid funeral contract has been cancelled and funds and interest accrued were not appropriately paid out;

2.A prepaid service was not fulfilled and a person was forced to go elsewhere; or excess pre-paid funds were not returned to the estate of the beneficiary.

3.There are allegations of professional misconduct or incompetence.

“There are protections to make sure the standards are consistent and that there’s accountability,” says Doug Kennedy, managing director of operations at Turner & Porter Funeral Directors. Kennedy sits on the Board of Funeral Services and is the past president of the Ontario Funeral Services Association.

Some funeral service providers allow you to arrange funerals online, so you don’t have to actually visit a home. This can be convenient, especially in cases where a funeral hasn’t been pre-planned and you don’t live near the deceased whose funeral you are arranging.

Online services tend to be more affordable because they have less overhead than a conventional funeral home.

One example of a company that offers Web-based services is Basic Funerals and Cremation Choices, a Mississauga-based licensed funeral establishment that has a physical funeral home location, but it mainly targets the online market.

Customers can peruse options and prices or chat with an online funeral director, then contact the provider via e-mail or phone to finalize details and payment.

“There’s really no reason you need to pull someone from their home and away their family at a time like that, especially for the arrangement process,” says the company’s CEO Eric Vandermeersch.

As such, a basic cremation through Basic Funerals costs $1,695; a burial and graveside service costs $1,800; and a basic funeral with casket is $3,200 (including taxes, fees and disbursements).

“If you compare what we offer to a traditional funeral home package, our services cost on average 50 per cent less,” Vandermeersch says.

Basicfunerals.ca can also film the service and stream it over the Web, particularly handy in a place like Toronto, Vandermeersch notes, where “there’s so many people here who have extended family elsewhere in the world.”

Beckett-Glaves Family Funeral Centre in Brantford also broadcasts funeral services online.

A growing number of traditional funeral providers also enable customers to browse options and obtain a quote online, but recommend that pre-planners eventually pay a visit to the funeral home.

“A funeral is not like buying a CD or book online,” says Jim Cardinal, president of Cardinal Funeral Homes. “There’s a lot more involved - decisions we want to make sure people are clear on.”

www.teambluesky.ca

How to Create the Perfect Wine and Cheese Pairing

Expert Ilse Chun Shares Her Secrets

Tomorrow is National Wine Day, and National Cheese Day follows close behind (June 4), so in celebration of this perfect pairing of holidays, here are some tips for wine and cheese pairing. We’ve also included some out-of-this-world recommendations from the experts at Napa Valley’s custom wine and cheese pairing firm, IJK Cheese Company, founded by James Ayers, the cheese specialist; Ilse Chun, the wine specialist; and Kris Chun, the business mind.

There are two ways to pair wine with cheese: pair like with like, or pair opposites. For example, acidic wine and acidic cheese share a common aspect and complement one another (e.g. sauvignon blanc and goat cheese), or an acidic wine may need a creamy cheese to balance it (like a peanut butter and jelly sandwich--the acid and the fat work together).

If you’re looking for something to bring the fruit flavors out in a young, tannic red wine, consider a salty cheese. Ilse Chun likens it to the Mexican practice of sprinkling salt in a fruit bowl--the salt brings out the fruit flavors.

How to taste: Take a sip of wine, then a bite of cheese, leave a little bit of cheese in your mouth, then take another sip of wine, letting the flavors meld together.

Check out the useful Cheese Wheel at Match My Wine.

There are two ways to pair wine with cheese: pair like with like, or pair opposites. For example, acidic wine and acidic cheese share a common aspect and complement one another (e.g. sauvignon blanc and goat cheese), or an acidic wine may need a creamy cheese to balance it (like a peanut butter and jelly sandwich--the acid and the fat work together).

If you’re looking for something to bring the fruit flavors out in a young, tannic red wine, consider a salty cheese. Ilse Chun likens it to the Mexican practice of sprinkling salt in a fruit bowl--the salt brings out the fruit flavors.

How to taste: Take a sip of wine, then a bite of cheese, leave a little bit of cheese in your mouth, then take another sip of wine, letting the flavors meld together.

Check out the useful Cheese Wheel at Match My Wine.

www.teambluesky.ca

Tuesday, May 28

Estate Partnerships Require Careful Planning

Mark Weisleder

If you invest in real estate with partners, there are important things you need to discuss in advance. This will protect you later from costly legal or accounting fees.

Here are some of the main things to consider:

Who is going on title?

If it is your first investment, I suggest that all partners be on title to the property, in their personal names, as opposed to a corporation. A lender will want all the partners to sign personally for the mortgage, so there is little advantage to spending the extra money to incorporate, with additional bookkeeping fees and tax returns. You can always get insurance to protect against claims related to liability.

How are decisions going to be made?

Key decisions include who to accept as a tenant and which renovations to undertake. Most of them should have majority approval, but in some cases, you may require decisions to be unanimous, to protect all of the partners.

Who signs the cheques?

Signing authority and how distributions are made to the partners is also a concern. I suggest that cheques up $1,000 or $2,000 can have one signature, but anything more needs at least two. There should be a separate account devoted to the investment, so there is no confusion about personal cheques being used to pay bills.

When is reporting to be done?

The partner who is managing the property should be required to submit monthly reports to the partners about the rents received and the expenses paid each month. There should be an annual report as well. This way each partner can make the appropriate income and expense reporting to the Canada Revenue Agency when filing separate tax returns.

How are disputes settled?

If things go to court, only lawyers win. Agree on a detailed and expedited arbitration process. That way the arbitrator’s decision is final, with no right to go to court, where it will inevitably get delayed and become expensive.

What if one partner dies?

There should be a process where the property is appraised and the partner who survives has to buy out the estate of the deceased partner at fair market value.

What if one partner wants to sell and the other partners do not?

There should be a similar process where the partners who do not wish to sell have to buy out the partner who wants to sell at fair market value, to be determined by an appraisal.

What if one partner doesn’t pay their share of expenses?

If one partner is not paying their share, then they should lose their right to make any decisions about the property. There should also be a formula so that the non-defaulting partners can buy out the share at a reduced value.

It is hoped that every real estate investment will lead to a profitable result and that no one will have the need to look at a partnership agreement. However, if things do not work out, it is good to know that the answer can be quickly found, without having to resort to costly legal or accounting procedures. By having the right legal and accounting advice before entering into a real estate investment with partners, you can ensure peace of mind for all partners involved.

www.teambluesky.ca

Thursday, May 23

Additional Costs when Buying a Home

Will You Need to Pay For Any Additional Costs?

While your down payment and mortgage will cover the purchase price of your home, it's wise to consider the other expenses involved in buying a home.

You'll pay some costs at the beginning of the home-buying process and others, known as closing costs or disbursements, when your home purchase is finalized.

Hidden costs that could add up when you buy your first home

Appraisal fee

Approximate Cost: $150 - $200

This is the fee for determining the property lending value for mortgage purposes. This value may or may not be the same as the purchase price of the home.

Home inspection fees (may not apply if you are purchasing a new home)

Approximate Cost: $300

The home inspector evaluates the structures and systems that make up your home and provides you with a written report. While not mandatory, many people make a professional home inspection a condition of their Offer to Purchase.

Property survey

Approximate Cost: $750 - $1,000

A survey indicates the boundaries and measurements of the land and positions of major structures, and any registered or visible easements (such as a driveway) or encroachments (such as a neighbour's fence) on the property.

Land transfer tax (if applicable)

Approximate Cost: $2,000

Levied in certain provinces whenever a property changes hands. In some cases, first time homebuyers may be exempt from a portion of this cost.

Legal fees and related expenses

Approximate Cost: $1,300 - $2,500

These fees vary by province and are subject to GST or HST where applicable. Ensure your lawyer's quote includes all related expenses and disbursements, not just legal fees. Make sure your interests are protected by discussing your Offer to Purchase with your lawyer or notary prior to signing.

GST/HST where applicable (sometimes included in sale price)

Varies based on Province

Some properties are GST and/or PST sales tax exempt and some are not. Generally, GST or HST where applicable is charged on new homes, but not on resale properties. Always ask before signing an Offer.

Title insurance

Approximate Cost: $250

Title insurance is optional and covers problems that may arise due to encroachment issues (for example, a structure on your property is actually part of your neighbour's property and needs to be removed), existing liens against the property's title, title fraud, undischarged mortgages and other issues relating to the property's previous owners.

Insurance costs for high-ratio mortgages

Variable

Usually, mortgage default insurance premiums range between 0.5% and 2.75% of the principal plus applicable fees (may be subject to provincial sales tax which cannot be added to mortgage amount)

If your down payment is less than 20% of the purchase price of your home, you must pay a one-time insurance premium on your mortgage amount. You can make arrangements to pay the premium to CIBC before closing, or it can be added to the principal amount of your mortgage. If it is added to the principal amount of your mortgage, you will pay interest on it at the same interest rate you pay on the principal amount of your mortgage.

Interest adjustments

Approximate Cost: $100 - $1,000

You will need to pay interest on any gap between the closing date of the purchase and the first payment date of the mortgage. You can avoid an interest adjustment by arranging to make your first mortgage payment exactly one payment period after your closing date.

Prepaid property tax and utility adjustments

Approximate Cost: $400 - $500

You will be required to reimburse the vendor for any prepaid property taxes or utility bills.

Home insurance

$450/year

Protection for your home and contents.

Mortgage life insurance

Variable

Costs vary but can be conveniently included in your regular mortgage payment.

Mortgage life insurance is optional and provides peace of mind. It protects your family’s financial security by paying off all or a portion of your mortgage (up to a maximum of $500,000) in the event of the premature death of you or your spouse.

Don’t forget to consider general expenses such as moving, upgrades, and home decorating costs as well.

www.teambluesky.ca

Monday, May 6

first time home-buyers: bide your time

supplied by The Globe & Mail

Pity the first-time buyer in today's housing market.

Wait, that's a bad idea. Giving someone your pity implies they are suffering and need a helping hand, which is not the case for young adults who can't afford to buy a house. It's an economic fact that Generation Y is being priced out of the housing market, but let's be careful in what we do about it.

We put so much significance on young people buying homes. It's how they join our tribe, so to speak. Owning a house means you’re buying into widely shared ideas of family, stability and consumerism. When young people buv homes, they validate the choices made by those who came before, and show they're ready to take their place in society.

You can see the importance society puts on home ownership in the targeted help provided to first-time buyers. Examples are the Registered Home Ownership Plan and successors such as the Home Buyers' Plan and the FirstTime Home Buyers' Tax Credit. Recently, the group representing mortgage brokers lobbied the government to provide additional help for first-time buyers.

Measures for first-timers are as much about the needs of the real estate industry as those of buyers.

We could better help young people buy houses by ensuring they have the education, training and career opportunities needed to generate the income required for ownership. Failing that, we need to understand and be okay with young people choosing to stay out of the housing market.

Respect the renter.

Members of Gen Y (born 1981-1999) see three big obstacles to buying a home today, Toronto Dominion Bank research shows.

1. Saving a large enough down payment:

Putting 5 Per cent down on a house costing the national average $378,532 requires savings of $18,927 plus an additional amount of up to $15,ooo or so to cover closing costs; also, it's tough to save at a time when rates on savings accounts top out below 2 per cent.

2. Prices:

The Canadian Real Estate Association s house Price index rose in March by the smallest amount in more than two years, but it was still up 2.2 per cent year over year.

3. Insufficient salaries:

House price gains have far exceeded wage growth, and there are also issues-with unemployment and underemployment. One further challenge for first-time buyers is the reduction last summer in the maximum mortgage repayment period to 25 years from 30 for people with a down payment of less than 20 per cent. The shorter the amortization period on a mortgage, the higher the payments are.

TD has produced a table, showing how much money someone should have to save weekly over five years to afford a 10-per-cent down payment on the average-price house in major Canadian cities. The required amounts ranged from a high of $281 in Vancouver to $98 in Winnipeg.

Self-discipline isn't the only thing required to meet these savings-goals. You also need a reliable paycheque, not the part-time or contract work so many young adults have. Student debt is another complication:

TD's research suggests that 23 Per cent of the Gen Y contingent is still repaying loans taken out to afford college or university.

The most recent data from Statistics Canada shows that about 70 per cent of Canadians own a home. and that the rate of home ownership has been rising for years. Gen Y isn't positioned to keep the momentum going, and that's going to worry parents, politicians and people in the housing industry.

Get over it, everyone.

For one thing, Gen Y may simply end up buying later in life. If vou figure living to 90 and are willing to work past 65, what's the harm in buying a house in your late 30s and targeting age 60 for mortgage freedom?

Condo living is another possibility for Gen Y, and so is permanent renting as long as it's accompanied by aggressive saving and investing. That way renter builds the same kind of financial base as home owners gradually paying off their mortgage.

Tax-free savings accounts are ideal for renters to use for their investing because they permit the same tax-free gains You get when selling your house (provided it's your principal residence). Gen Y, bide your time. Rent as long as you need to build up your down payment, and don't buy until you can afford the full range of home ownership costs (more on that next week). Saving longer makes you stronger.

www.teambluesky.ca

Keeping Your Home Safe

by Mike Elgan

Turn a Smart Phone Into a Security Camera

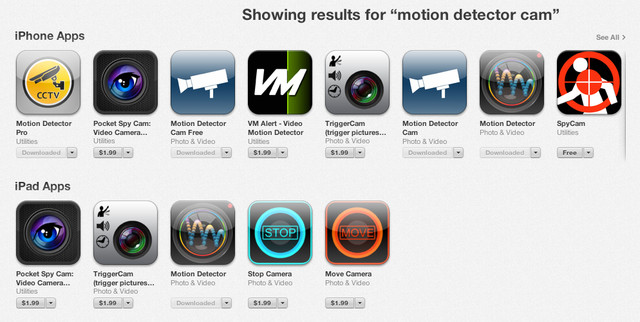

One way to keep your home safe is to set up motion-detection security cameras. Unfortunately, these can be expensive, especially if you need them only once or twice a year. My favorite trick is to use old smart phones and tablets for a free and effective security system. All you need is a device capable of taking a picture, connecting to the Internet and running apps. If you're like some gadget enthusiasts, you've got a box full of them somewhere. |

Here's how you do it.

|

Control Your Door

If you're going to be away for a while, you might want people to check on the house, feed the goldfish, water the plants, that sort of thing. But you might not want to be handing keys out to people. A nice alternative is the Lockitron door lock from Agipy. It functions like any other lock. The difference is that you can lock and unlock it remotely using an app, even if you're out of town. You can also send virtual "keys" over the Internet, allowing someone to unlock your door with a smart phone. Those keys can have expiration dates, so if you want someone to check the house only on Wednesday, the key won't work on Thursday. Likewise, if someone needs to enter your house for some unexpected purpose while you're away, you can use Lockitron to unlock your door remotely via the smart-phone app. Or you can send a key via SMS or email. Lockitron even has a knock sensor. If someone knocks on your door, you can receive a notification. |

If crooks suspect you're not home, they'll often test that theory by simply ringing your doorbell to see if anyone answers. One new product, called the Edison Junior DoorBot, lets you answer the door even if you're on the other side of the world.

When someone rings the bell, you'll get an alert on your phone. By using the smart-phone app, you can see who's there via the DoorBot's built-in camera and talk to them over your phone and through the DoorBot's speaker and microphone. By combining DoorBot with the Lockitron, you can see who's there, talk to the person and then let him or her in the house. Or, if it's someone you don't want in your house, the person will assume you're there because you're answering the doorbell over what appears to be an intercom system. Or you can call the police. Best of all, DoorBot could be a helpful addition to your front door even when you're not traveling.

www.teambluesky.ca

|

Friday, May 3

SELL YOUR HOME FAST

Avoid these seller mistakes to ensure your property is sold as quickly as possible.

While homes in big cities may sell quickly, outside major centres homes can sit on the market for months and months. Sometimes it's a slow market. Sometimes it's silly mistakes made by sellers. Whether you are selling in the city or hoping to move your rural property into new hands, don't make these mistakes:

Overpricing

You may have put a lot of love and a lot of money, into your home, but buyers don't care. They aren't comparing the home before you loved it with the one you're selling now; they're comparing your home to all the other options on the market. If you start off too high, you'll stop all the people who might be interested from even looking at what you've got.

Limiting showings

Really? You're trying to sell your home but you're not making it available when buyers want to see it? While it might be a major pain in the ass being on call for showings at the drop of a text, if you want that puppy gone, you'll have to make it easy for buyers to see it.

Failing to prepare

Would you want to buy a home that was full of clutter, needed repairs or had a front yard that had run to weeds? The guy who you're trying to convince doesn't either. Rumour has it that it takes only about 60 seconds for a prospective buyer to form an opinion about a home. I know that of the four homes I've bought, I knew it was "the one" within minutes of walking in the door. Clean out the crap, tidy up the cupboards and the garage, stash your excess stuff in a friend's basement until the home sells. And make sure the place smells wonderful. (You'll benefit from that too.)

Becoming offended

A low-ball offer hasn't been made to offend you, it's the buyer's signal that the negotiation is going to be a rollercoaster ride. Buckle up, but keep smiling. Letting your emotions get in the way of a deal is immature. This is a business deal, treat it as such.

Thwarting inspections

If you're afraid of what an inspection might turn up, rather than get in the way of the inspection process, hire your own inspector to highlight what you need to fix. If you aren't prepared to replace the 34-year-old furnace or 15-year-old roof, be prepared for the buyer to negotiate the cost of a new one off your sales price.

www.teambluesky.ca

Thursday, May 2

10 Doable DIY Projects for Your Outdoor Space

SPRING PATIO SPIFF-UPS

By Laura Gaskill

With advance planning and perhaps a few friends to help (bribe them with dinner out), you can make a big difference in your patio in a single weekend. Arranged from fast and easy (hang lanterns, make a repurposed table) to more time- and labor-intensive (create a canopy, paint the floor) projects, these DIYs are sure to offer something to suit your time commitment and style.

1. Make a quick table.Cluster a trio of ceramic garden stools together and top them with a glass tabletop for a nearly instant outdoor coffee table.

2. Warm up a look with candles and solar lights. Enhance the ambience at night by setting out lanterns filled with votive or battery-operated candles, solar garden lights and string lights. Try surrounding your seating area with lights, light up the pathway or place lights in the landscaping along a fence line.

|

by Sandy Koepke »

3. Enhance your seating area with a backrest. Use a small curtain rod with decorative finials to re-create the look of this eclectic patio seating area. Just be sure to measure the hanging height of your rod with someone seated there — you don't want it so low that it will be bumped into. Finish by sewing fabric ties to a rectangular cushion and hang it from the rod.

by Key Residential »

|

4. Try a wall planter. Jazz up a big, empty wall with a wall-mounted garden. Use store-bought planters designed for this purpose or fashion your own using found materials.

More ideas for vertical gardens |

by Laura U, Inc. »

|

5. Add style and privacy with outdoor curtains. Outdoor curtains can be pulled closed to block unsavory views, provide privacy from close neighbors and shade you from the sun — and even when open, they add to the ambience.

If you have any sort of framework or roof on your patio, you can attach curtain rods. Be sure to choose hardware and curtains meant for outdoor use for the most durability. |

6. Repaint outdoor furniture. Give your old patio furniture a lift with a bright new coat of paint. Even metal furniture can be repainted — look for a paint designed for use on metal, such as Rust-Oleum.

Don't feel like doing it yourself? Have your metal patio set powder coated at an auto paint shop instead. |

7. Create a chic new floor with gravel. If the only space you have to work with has a floor made of cracked concrete or unsightly asphalt, consider covering it up with a few inches of compacted, crushed gravel.

8. Build a unique planter from cinder blocks. Architectural photographer Zack Benson came up with the innovative idea of using stacked and glued cinder blocks to create a cheap and easy DIY succulent planter. You can find more information about this project on his blog.

9. Filter the light. Unfurl rolls of bamboo trellising over a pergola or similar structure (free of plants) to form a roof that will protect you from the sun. If you can climb a ladder and wield a hammer, this should be a pretty doable weekend project. Attach the bamboo using a heavy-duty staple gun or by hammering in U-shaped nails.

10. String up a canopy.Whip up a lovely, albeit temporary, outdoor roof by tying lengths of lightweight fabric to bamboo stakes, fence posts or even a nearby tree.

www.teambluesky.ca

You Dont Have to Forgo Wine When Enjoying BBQ

The Daily Sip

Smoke, sauce, and slaw? We’re up for the challenge.

|

A pork shoulder cooked low and slow over hickory? Sounds delicious, but what wines can you pair with this BBQ classic? We’re not opposed to a cold beer while tending the smoker, but love the challenge of pairing wines with whatever dish lands on your table. A purist, enjoying the meat on its own? Try a Cotes-du-Rhone. Typically a Grenache-based blend, this classic French wine has the versatility to refresh between bites and lets the character of the meat you worked so long and hard to achieve shine through. For a domestic pick, try Zinfandel. The jammy and peppery notes of a Zin will practically sauce the meat for you. If you have a very spicy rub, be careful, as the high alcohol levels of some Zins can fan the flames. A pork shoulder cooked low and slow over hickory? Sounds delicious, but what wines can you pair with this BBQ classic? We’re not opposed to a cold beer while tending the smoker, but love the challenge of pairing wines with whatever dish lands on your table. A purist, enjoying the meat on its own? Try a Cotes-du-Rhone. Typically a Grenache-based blend, this classic French wine has the versatility to refresh between bites and lets the character of the meat you worked so long and hard to achieve shine through. For a domestic pick, try Zinfandel. The jammy and peppery notes of a Zin will practically sauce the meat for you. If you have a very spicy rub, be careful, as the high alcohol levels of some Zins can fan the flames.But how many of you enjoy pulled pork without accompaniment? Usually there’s sauce, slaw, and a bun involved. If you cannot resist the lure of thepulled pork sandwich, try to find a wine that compliments all of these flavorful components together. How about a still or sparkling rosé? They have enough red wine character to handle the savory meat along with the zip and zing for a vinegar-based slaw. Lambrusco, whether bone-dry or with a touch of sweetness (depending on the sauce you choose), would also be a fun partner with your pulled pork sandwich. There’s nothing wrong, however, with still craving a big red like Petite Sirah. Just try putting a slight chill on it to mellow out the oak, tannin, and alcohol influence. |

Subscribe to:

Posts (Atom)